The ecological footprint in cryptos

The power consumption of Bitcoin, Ethereum and other proof-of-work based blockchain networks has become a real concern.

How much energy do Bitcoin and Ethereum consume? How do they compare to energy consumption like Tezos and new blockchains?

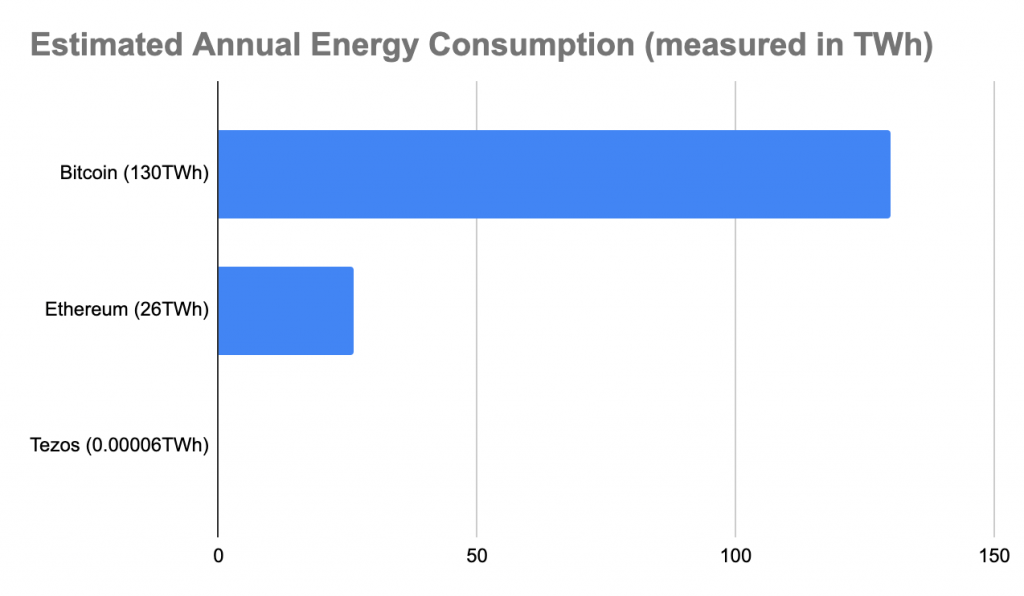

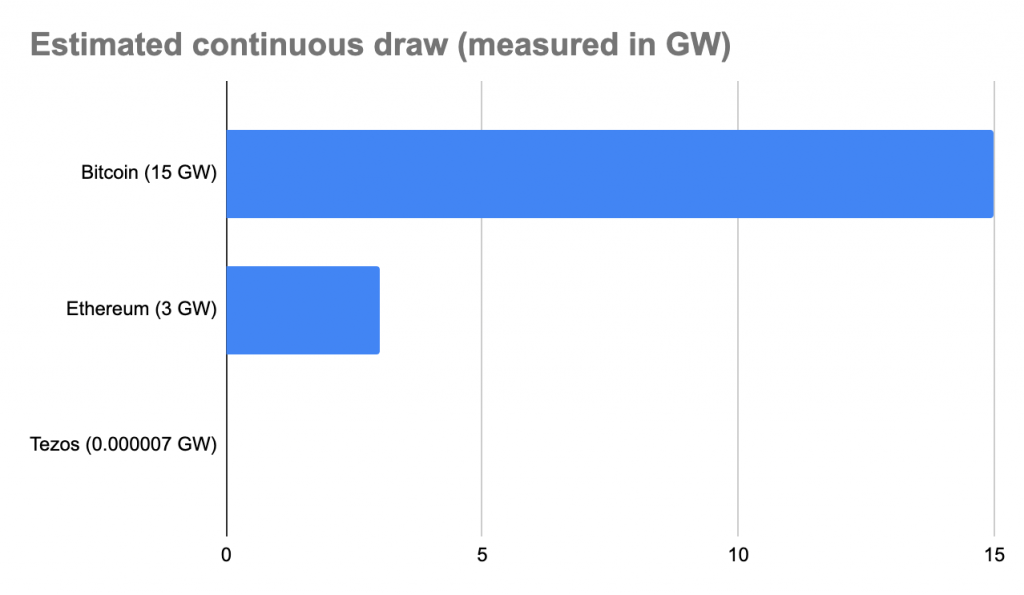

According to the University of Cambridge, Bitcoin's current annual energy consumption at 130 TWh, a continuous consumption of 15 gigawatts of electricity.

Some estimates of Ethereum's annual energy consumption place it at about 26 TWh, a draw of 3 gigawatts.

The carbon footprint of these two technologies is absolutely enormous, comparable to that of entire countries.

On the other hand, the energy used annually by the Tezos network validators is probably on the order of 60 MWh, a continuous consumption of perhaps 7 kilowatts.

These numbers differ by a factor of more than two million, between six and seven orders of magnitude.

Thanks to the Proof of Stake protocol, the Tezos blockchain is infinitely less energy intensive than blockchains such as Bitcoin or Ethereum, an essential feature in the age of energy transition.

In the background, Ethereum is trying to take this reality into account with a possible evolution of the protocol that will undergo important changes normally scheduled for June 2022.

The Tezos blockchain remains at the forefront and offers a reliable and sustainable solution. It is distinguished by three key points:

-

Eco-responsible, thanks to its low energy consumption consensus algorithm (Proof of Stake)

-

Reliable, thanks to the use of technologies directly resulting from research, use of formal proof and more secure thanks to the choice of the OCaml programming language

-

Evolutive, through its self-amending mechanism (avoid forks and simply adopt innovations from other protocols)